Mobile home financing How to buy older manufactured homes

Table of Content

- Tie Downs And Other Hud Guidelines

- How to get manufactured home financing: 5 types of loans

- Manufactured Homes Go To Washington: Homes On The Hill Returns For 2022

- Say No To Credit Card Offers

- Gen Z’ers Are Now Buying Homes. Here’s Why Manufactured Homes Are So Popular With Them.

- How we make money

- Compare Manufactured Home Loan Lenders 2022

FHA loans have specific requirements when it comes to credit scores and debt-to-income . Credit score requirements tend to be a bit lower than other mortgage loan programs. The general rule for FHA debt-to-income ratios is that your house payment should not exceed 31% of your income. Adding your house payment to the rest of your debt should keep your total debt at or below 43% of your income.

The Manufactured Home must be at least 12 feet wide and have a minimum of 600 square feet of gross living area. Another efficient way to search available open land is to reference the area MLS. You may be able to browse listings of property acquired and cleared by the county, through a housing authority or county land bank.

Tie Downs And Other Hud Guidelines

Whenever you apply for any financing, a lender will consider your credit as part of your loan application. Clean credit histories and solid credit scores make securing loans easier and receiving better rates and terms from lenders. Personal loan lenders usually offer maximum loans of $25,000 to $50,000, though some lenders will let you borrow $100,000 or more. If you see a lender offering a personal loan large enough for financing a mobile home, it might be a good way to borrow the money that you need.

Veterans Administration loans are another way to buy a manufactured home. If you’re buying the home without the land, the maximum is $69,687. InCharge is a nonprofit credit counseling agency that provides a free snapshot of your credit report. It can help you come up with a repayment plan for credit card debt, such as a debt management program. All have features of traditional homes, including optimal energy efficiency. The homes must be placed on flat land, or land that has been prepared to accept the modules.

How to get manufactured home financing: 5 types of loans

If you put less than 20% down your home will be under more scrutiny by Canada Mortgage and Housing. The higher your down payment, the better.Your lender will most certainly insist on a home inspection and a professional appraisal to ensure your home is worth what you have offered . Lets look at some other important differences in these housing types.

Never accept a loan offer before researching your choices, especially if you’re putting the home on a piece of property that you own. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. Mortgage insurance is cancellable once the borrower reaches 20% equity, resulting in savings during the life of the loan.

Manufactured Homes Go To Washington: Homes On The Hill Returns For 2022

If the home doesn’t meet all the requirements, you may need a personal loan, a chattel loan, or a special FHA Title I loan. Unlike traditional real estate, which tends to appreciate in value, manufactured homes can either depreciate or appreciate depending on their age, location, and upkeep. Newer, well-maintained homes typically appreciate at the same pace or even faster than traditional homes, while older, more rundown homes can depreciate over time. Many homebuyers choose conventional mortgages because they offer the best interest rates and loan terms - usually resulting in a lower monthly payment.

The same is true for cars, and that’s one reason car loans usually come with shorter terms and higher interest rates. It’s also why there is an entire industry built around recovering runaway autos. So the government created minimum safety requirements to protect buyers.

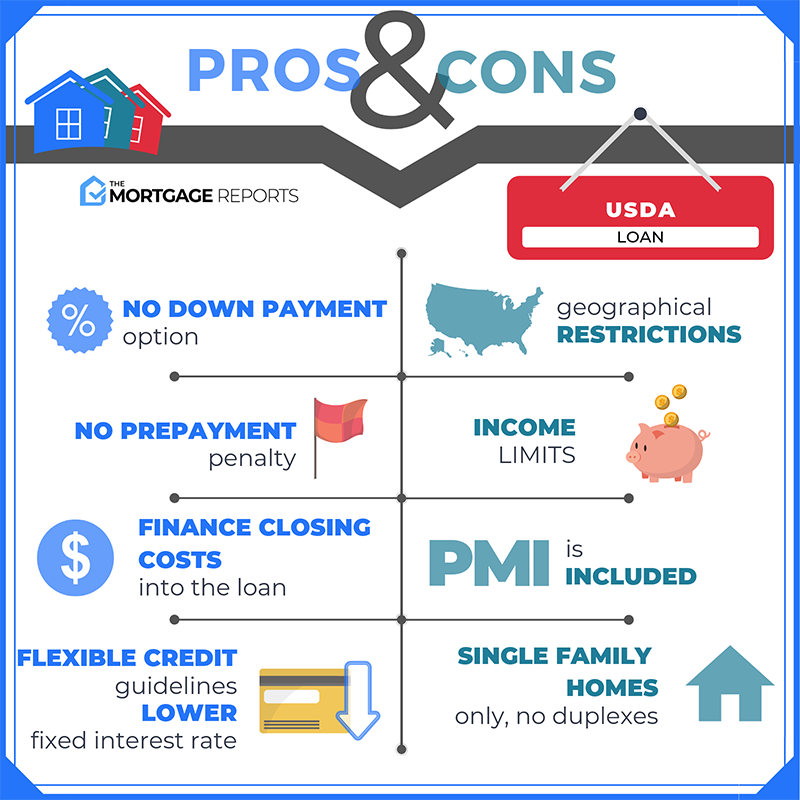

Like all USDA loans, USDA manufactured home loans work only in rural and suburban areas — and only for buyers who fall within income limits. The FHA can also help you buy the plot of land for your new manufactured home through a process that resembles a construction loan. FHA loans exist to help credit challenged borrowers buy affordable housing. That June day in 1976 is important because it’s when the Department of Housing and Urban Development started regulating the safety of manufactured homes. Like traditional homes, the cost of mobile home insurance policies varies based on your coverage level. If you belong to the military community, you may qualify for a loan insured by the Department of Veterans Affairs.

To qualify for this program, the home must also meet certain construction, architectural design and energy efficiency standards similar to site-built homes. According to the Housing Act of 1980, factory-built homes constructed on or after June 15, 1976, are manufactured homes. HUD highly regulates the construction of these homes under the Manufactured Home Construction and Safety Standards .

Conforming loan limits are based on the average home price of an area and change each year to reflect the current home values. Conforming loan limits also establish which loans can be purchased by Fannie Mae or Freddie Mac on the secondary mortgage market. Because lenders can more easily sell conforming loans, they tend to make these loans more affordable for borrowers . If that’s the case, you may worry that your financial situation will never improve.

This also makes lenders less likely to approve loans for these homes. However, in areas where more people own mobile homes, it’s probably easier to find better financing. The darker areas in the map above indicate areas with a higher percentage of manufactured or mobile units. But keep in mind manufactured houses tend to depreciate, or lose value, as they age. This also makes lenders less likely to approve loans with competitive interest rates for these homes.

Comments

Post a Comment